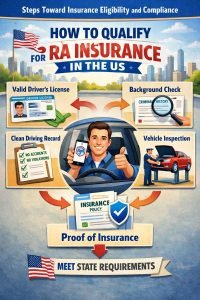

Many consumers ask how to qualify for RA insurance in the US, particularly after major violations. Qualification generally depends on demonstrating insurability, providing accurate driving records, and meeting state filing obligations. Contrary to misconceptions, denial from standard insurers does not preclude RA insurance eligibility.

Applicants may qualify through assigned risk programs, specialty insurers, or non-standard carriers. Maintaining continuous coverage and avoiding further violations are key to improving long-term eligibility and reducing premiums.

This topic holds strong SEO value because it addresses foundational concerns and positions the website as an authoritative guide.